As a social impact enterprise, it should come as no surprise that a big focus for WaFunda is on impact. Impact can be seen as a broad, somewhat generic term, and so for the purposes of this blog, we refer to impact as the influence that our products and services have on the young people we support.

Our work at WaFunda is focused on ensuring that young people are educated, that their wellbeing is supported and nurtured, and that they are able to earn a decent income. Ultimately, we want young people to become active members of society. So, when we talk about impact, we mean the real, tangible difference that our work makes in the lives of our beneficiaries. Impact is the knowledge they gain, the qualifications they obtain, the skills they build, and the income they earn to support themselves and their families.

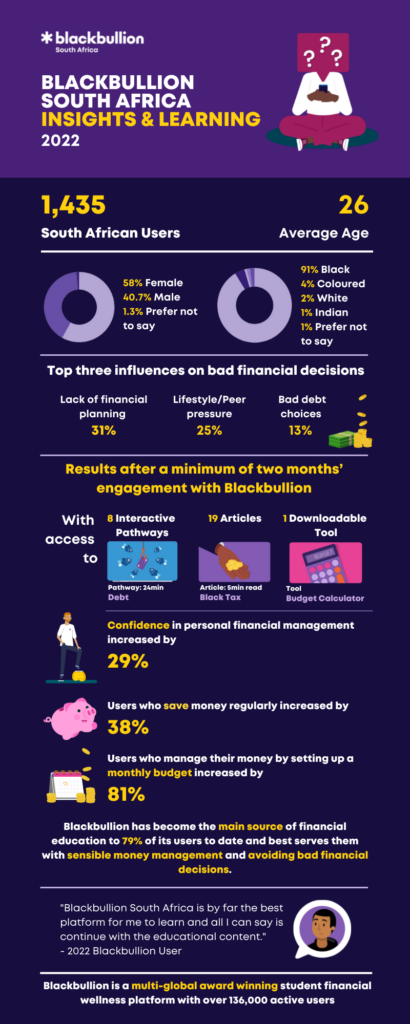

That’s why we have prioritised data collection and impact at every step of the way in launching the Blackbullion SA platform. When it comes to financial literacy, there are a number of different ways that impact can be measured. According to our theory of change, the impact we are aiming for is positive behaviour change when it comes to money and personal finances. Related to this is building confidence and a positive financial mindset, and reducing the stress and anxiety associated with money. We are teaching young people to create a budget, educating them on what it means to save and invest, and helping them to better understand debt and credit. Beyond these core topics, we are supporting them to build a positive relationship with money as they become financially independent.

The Power of Data

So, how do we monitor our impact and gather useful insights from our Blackbullion SA users? Firstly, the platform collects and aggregates detailed information about the engagement and progress of every user. Our analytics dashboard shows which modules users have completed, how well they did on the assessments, and which pathways are the most popular. This is visible for each individual user, for specific groups of users filtered by demographic information, and for entire cohorts and groups of users. Not only is the analytics dashboard an excellent tool for tracking and reporting on learning behaviour, we also use this data to inform our engagement and incentives strategy and our content roadmap. If there are particular areas where users are struggling, we can deliver supplementary content and encourage the users to prioritise specific modules.

In addition to the data collected via the platform, we gather important information at other points during the user journey. When young people sign-up, we ask them to complete a baseline survey which gathers information on their current financial knowledge and behaviours. Do you have a savings account? Are you currently in debt? Do you have a budget? We then regularly survey users with the same questions to track changes in attitudes and behaviours as a result of using the Blackbullion SA platform. This self-reported data is extremely valuable in demonstrating how Blackbullion SA is impacting young people’s lives. Another valuable source of data comes via our community building efforts in which we engage with our users across multiple communications channels including live webinars, email journeys, and social media campaigns. For example, direct engagement with our audience during live webinars gives us feedback on the topics that young people want to learn more about. This was the case for our second webinar, which was focused on ‘Side hustles’, a direct request from the attendees of the previous live session. And the ‘Money confessions’ campaign that ran on our social media channels gave us some very real and honest insights into the financial behaviour of young people. Asked to anonymously share their money mistakes, our audience gave some fascinating answers, including stories about losing money to gambling and cryptocurrency.

Transforming Data into Insights

So, what do we do with all this amazing data? Firstly, we learn from it. We use it to inform our product roadmap and sales and marketing strategy and, more importantly, we use it to try and better understand the young people who we support. This data is also very valuable for our clients and funders to demonstrate the value and impact of their investments. Our focus on data collection, monitoring, and insights is one of the things that sets Blackbullion SA apart from other financial education products. We don’t just want to know if our users have signed up, we want to know exactly what they’re learning, how they feel about money, and how they make financial decisions. We believe that financial literacy is gained over time, with consistent exposure to important topics and ongoing support during the journey to financial independence. The only way to do this properly is to have real, data-driven insights into the choices and behaviours of the young people who use our platform.

Finally, we also want to share this information with anyone with an interest in youth development and financial education. We like to be open-source when it comes to impacting young people so we’re hosting a free insights webinar soon to share what we’ve learned about young people and money over the past two years. We’d love to see you there!

Check out our student insights infographic